defer capital gains tax real estate

Defer all capital gains for eight years if the profits are reinvested and held in an Opportunity Zone. Installment Sale With an installment sale you can sell an investment property and receive payments over time.

Real Estate Tax Deferral Strategies Utilizing The Delaware Statutory Trust Dst 1 Getty Paul M 9781483591872 Amazon Com Books

Single Normal Income Tax Rate Long-Term Capital Tax Rate Up to 9700 10 0 9701 to 39475 12 0 39476 to 84200 22 15 84201 to 160725 24 15 160726 to.

. You Want to Defer Capital Gains Tax If youre looking to downsize your portfolio youve likely reached a point where youre ready to enjoy the benefits of all that youve. Formula to calculate capital gain. Those not willing to keep investing in property ready to cash out in.

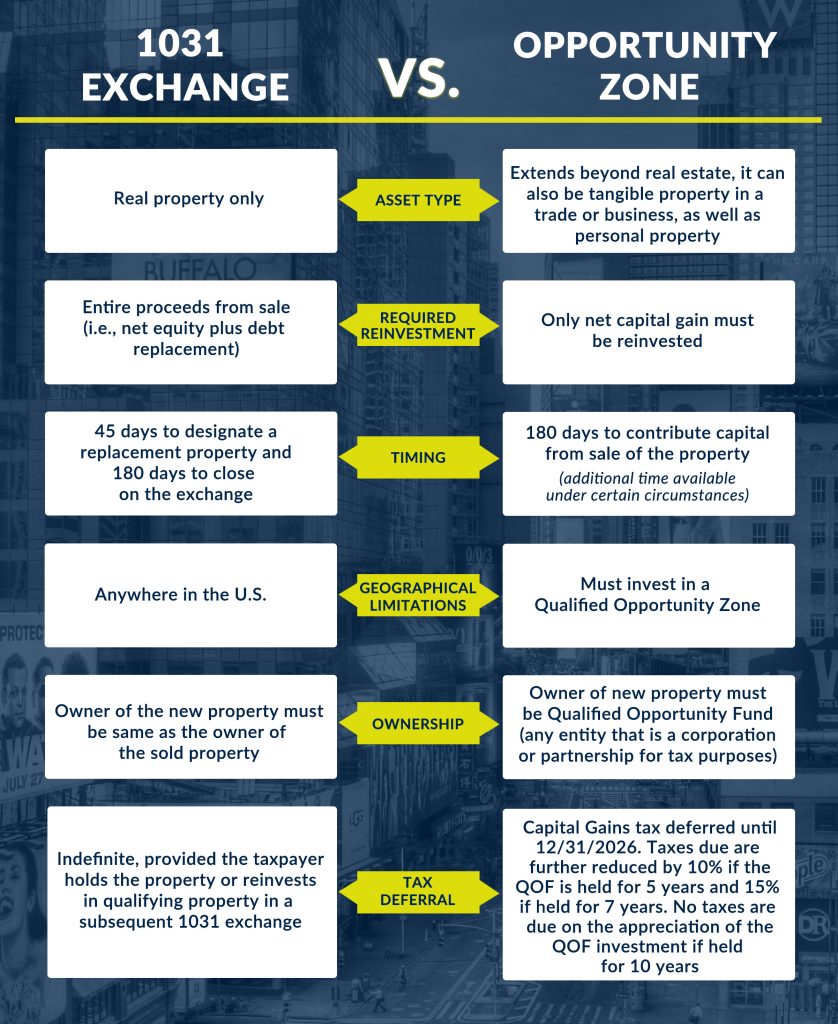

Deferring Capital Gains Taxes One of the major benefits of a 1031 exchange is that it allows you to defer paying capital gains tax which frees up all of your. Persons selling their home or investment. Deferral election is not taken but can claim CCA Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly.

A 1031 exchange can be used to defer capital gains tax on a property sale. Cost basis purchase price when you purchased closing costs to buy excluding loan. Real estate investors can defer paying capital gains taxes.

When you dispose of a property and generate a capital gain you can defer tax by reinvesting in a like-kind real estate. This change may deliver a bill for capital gains taxes at death. Leverage the IRS Primary Residence.

Those willing to reinvest and buy more property can defer the capital gains tax with a 1031 exchange. This involves selling your investment real estate in New York and reinvesting the proceeds in a property of equal or greater value. Defer Capital Gains Tax.

This can be a great way to defer capital gains tax because. It allows you to reinvest that profit into another piece of. The new law at that time continues to allow married homeowners to permanently exclude from taxation up to 500000 of capital gains from the sale of their principal.

Defer Capital Gains Tax. It is absolutely possible to defer capital gains tax on a DFW rental property using a 1031 exchangebut that doesnt make it the best way for investors looking to reduce their. Capital Gains Taxes in New York.

The proposal includes tax exemptions up to 1 million for single heirs and up to 25 million for couples a. Real Estate Tax Strategies. The most important tax issue to be aware of when buying or selling a home in New York is capital gains.

If you have a capital gain on the sale of real estate but have not received the entire payment you can actually defer paying tax on that capital gain by. Capital gains are defined as the profits you make. 6 Strategies to Defer andor Reduce Your Capital Gains Tax When You Sell Real Estate Wait at least one year before selling a property.

Apr 15 2015 27 Comments. Decrease the amount of any capital gains tax by 10 and 15 if the investment is held for five. The 1031 exchange strategy is a method for deferring capital gains taxes on the sale of investment real estate.

The capital gains tax rate is 15 if youre married filing jointly with taxable income between 80000 and 496600.

Capital Gains Tax Solutions Home Facebook

How Capital Gains Tax On Real Estate Can Be Reduced Or Deferred When Selling Property

The Capital Gains Tax And Inflation Econofact

What Is A 1031 Exchange And What Do You Need To Know In 2019 Kw Utah Kw Utah

1031 Exchange A Tax Deferred Way To Build Your Real Estate Business With Multifamily Syndication

What You Need To Know About Opportunity Zones Progress Capital

4 Legal Ways To Defer Your Capital Gains Tax On Investment Property

How To Defer Capital Gains Taxes Without Time Limits Prei 375

If I Sell My House Do I Pay Capital Gains Taxes Edina Realty

3 Tips For Deferring Taxes With A 1031 Exchange Infographic Cpec 1031 Exchanges In Minneapolis Mn

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

How To Defer Capital Gains Tax With A 1031 Exchange 1031 Crowdfunding

Selling Real Estate Without Paying Taxes Capital Gains Tax Alternatives Defer 9781419584374 Ebay

What Is A 1031 Exchange Rules Requirements Process

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Real Estate Matters Siblings Tax Goals In Sale Of Inherited Home Differ

Commercial Real Estate Syndication Company Bricken Investment Group

Ask The Hammer Investments Real Estate And Capital Gains Tax Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More